View: Source

The dynamics behind silver’s $50 rally include CoT data and the bullish chart patterns. Both will determine when the silver price will start its long-overdue rally to $50/oz.

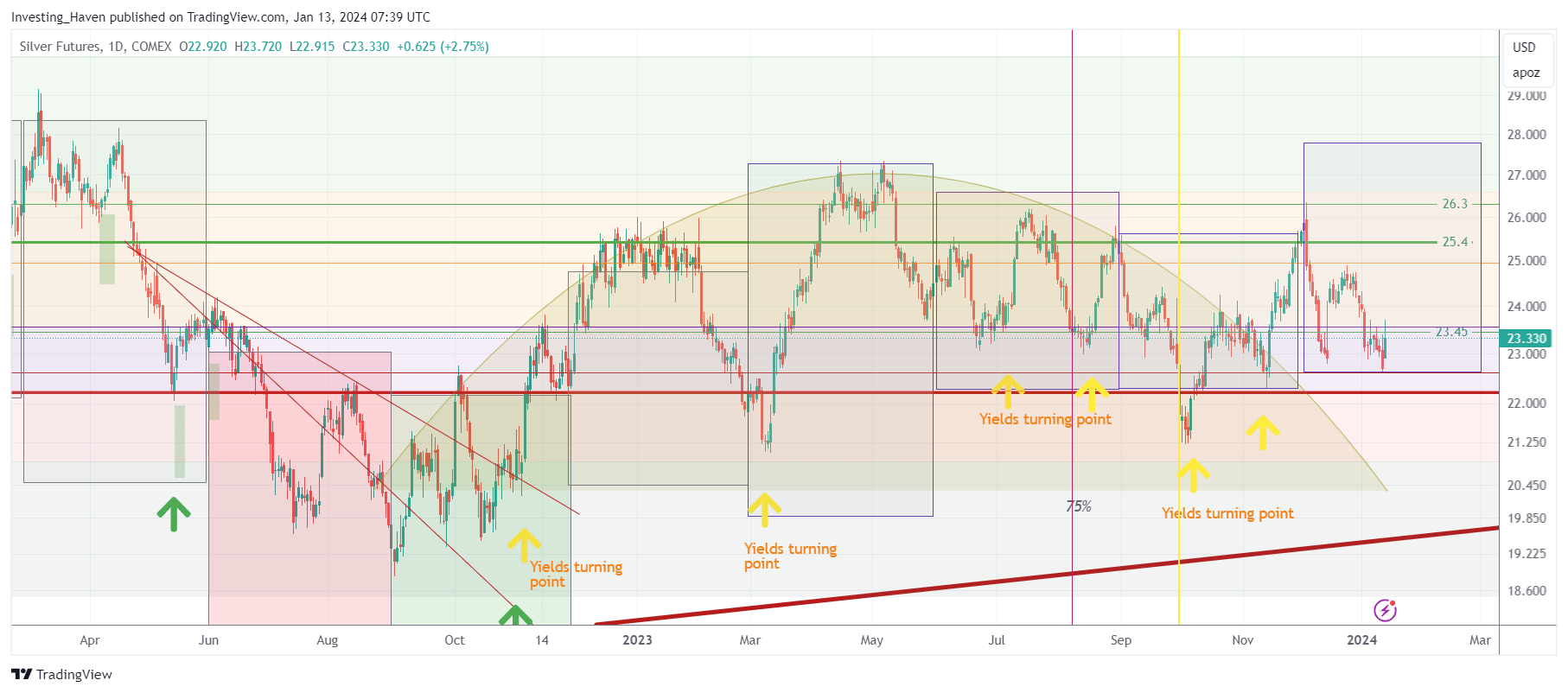

As the silver market buzzes with speculation about its potential rally to $50, silver investors are eager to understand the exact timing of silver’s epic price surge. While pinpointing the exact moment is challenging, two critical data points offer insights into the conditions required for such a significant price movement. This article provides insights into the conditions that need to be met in order for silver to start its next big run. In sum, we do expect the big silver run to start in 2023 and move to $50 in two phases.

The quest to predict the timing of a price rally is a common pursuit among investors seeking to better understand the silver market. Particularly, silver’s potential rally to $50 has captured attention due to its implications for traders and long-term investors alike.

Silver – the restless & trendless metal

The silver market, unlike many other markets, is unusually volatile, evoking emotions like fear and excitement, also testing patience of its holders, which prevents many of seeing the richness of patterns on its chart.

Silver is often called the ‘restless metal‘ because of its highly volatile nature. While silver has the ability to stage strong trends, in both directions, most of the time it is trendless. That’s why we would ‘trendless’ silver’s restless nature.

Here is the point with silver: it is BECAUSE of the fact that is trendless most of the time that it is such an interesting investment. The waiting is made up when it starts trending. The uptrend, which we expect to occur soon, is so powerful that you don’t want to miss out.

As explained many times, silver is working on a long term consolidation. The longer the duration of a consolidation, the more powerful its outcome. That’s why we are not concerned about silver’s prospects as long as it respects its 2022 & 2023 support area.

Silver supply shortage

In our analysis silver shortage 2024 we concluded:

The looming silver shortage stands out as a ticking time bomb. Despite COMEX silver price setting, the law of supply and demand will eventually prevail. As we approach a true silver supply shortage, the silver market’s true potential awaits, ready to reshape the price setting dynamics and elevate silver to new heights.

Indeed, the silver shortage is developing into a really serious problem. It seems to be getting worse with each passing month, as evidenced by recent data:

We believe that the physical market ultimately will take over control. Price discovery, orchestrated from within the silver futures market (COMEX) is not a sustainable price discovery dynamic.

Unless this physical silver market supply shortage resolves, which is very unlikely, the silver price rise to $50 seems inevitable.

Silver COT Report Analysis

One of the tools at the disposal of traders and analysts is the Commitment of Traders (COT) report, which presents a snapshot of market sentiment based on the positions of different trader categories. Currently, the silver COT report paints a bullish picture. The net positions of commercials and non-commercials are bullish. This suggests a collective belief in the potential for higher silver prices.

For a detailed explanation of this next chart we refer to our weekend analysis, shared with premium members of the Momentum Investing service, available in the restricted area This Is A Buy & Hold Environment For Quality Stocks.

Silver Price Chart – Rounded Pattern Breakout Might Be Last Hurdle Before The Rally To $50 Will Start

Technical analysis often reveals patterns that provide valuable insights into future price movements. The 9-month rounded pattern visible in the silver price chart hints at a potential turning point. Such patterns are considered significant as they indicate a shift in sentiment from bearish to bullish or vice versa. If the pattern breaks to the upside, it will confirm a secular breakout attempt. This breakout might signify the beginning of a new bullish phase for silver, possibly setting the stage for the anticipated rally.

Historical Context

Silver’s history is marked by periods of significant price surges driven by various factors. Looking back, the metal has demonstrated its potential to deliver substantial gains within short timeframes. These historical instances underline the notion that silver is capable of sudden and powerful price movements. While history doesn’t repeat itself exactly, it does provide valuable insights into how external factors can propel silver prices higher.

Two Stages of the Silver Price Rally to $50

It’s important to understand that predicting a silver price rally to $50 doesn’t mean a single, uninterrupted climb. The journey could involve two distinct stages. The initial stage might see silver moving toward $34, driven by a combination of technical and fundamental factors. Once this stage is achieved, the path to $50 could follow, supported by strengthening market sentiment, potential supply-demand imbalances, and external catalysts.

Conclusion

As investors eagerly await silver’s ascent to $50, a nuanced understanding of market dynamics and technical patterns is crucial. While precise timing remains uncertain, monitoring the silver COT report, analyzing price patterns, considering historical context, and acknowledging the potential for a two-stage rally can offer a well-rounded perspective. In the dynamic world of commodities, informed decision-making remains paramount.

By incorporating these insights and analyses, investors can approach the silver market with a more informed outlook, aligning their strategies with potential price movements.